Discover Leading Wyoming Credit: Trusted Financial Institutions

Discover Leading Wyoming Credit: Trusted Financial Institutions

Blog Article

Why Cooperative Credit Union Are the Trick to Financial Success

Credit scores unions have actually emerged as a compelling choice for those looking to boost their financial health. With a focus on community-driven efforts and customized solutions, debt unions stand out as essential gamers in cultivating monetary success.

Advantages of Joining a Lending Institution

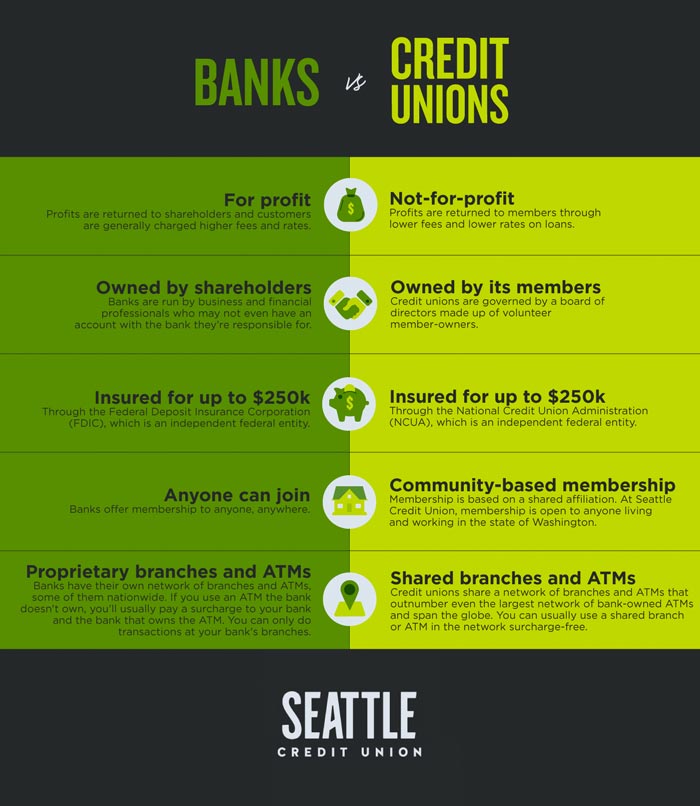

Joining a credit report union uses countless advantages that can positively impact one's financial wellness. Unlike conventional banks, credit score unions are member-owned cooperatives, which implies that each participant has a voice in exactly how the union operates.

Furthermore, lending institution frequently provide better customer service than larger economic organizations. Participants usually report greater complete satisfaction levels due to the personalized attention they get. This dedication to member solution can lead to tailored financial services, such as customized car loan options or financial education programs, to aid participants achieve their economic goals.

In addition, belonging of a lending institution can use accessibility to a range of economic products and solutions, often at even more competitive prices and with reduced costs than conventional financial institutions. This can lead to cost financial savings over time and add to total economic stability.

Affordable Prices and Reduced Costs

Cooperative credit union are understood for providing competitive rates and reduced charges contrasted to conventional financial institutions, providing participants with affordable economic solutions. Among the crucial benefits of cooperative credit union is their not-for-profit status, allowing them to focus on member benefits over making best use of revenues. This distinction in structure frequently converts into far better rate of interest on interest-bearing accounts, lower rate of interest on finances, and minimized costs for numerous services.

Personalized Financial Providers

With an emphasis on meeting private monetary requirements, credit history unions stand out in supplying individualized financial solutions tailored to enhance participant complete satisfaction and monetary success. Unlike traditional financial institutions, lending institution prioritize understanding their participants' special financial circumstances to offer customized remedies. This personalized method allows lending institution to offer a series of solutions such as tailored monetary guidance, tailored financing choices, and individualized cost savings plans.

Members of cooperative credit union can profit from customized economic solutions in various means. When looking for a financing, credit score unions consider aspects past simply credit history ratings, taking into account the participant's background and specific requirements. This strategy often causes much more desirable lending terms and greater authorization prices contrasted to banks. Furthermore, credit score unions use individualized financial guidance to assist members achieve their monetary objectives, whether it's conserving for a significant acquisition, intending for retirement, or boosting credit rating.

Community Support and Involvement

Stressing public participation and promoting interconnectedness, credit report unions actively contribute to their communities via durable support initiatives and meaningful involvement programs. Area support is at the core of cooperative credit union' worths, driving them to go beyond simply monetary services. These establishments frequently participate and arrange in various local occasions, charity drives, and volunteer tasks to give back and reinforce the neighborhoods they offer.

One way lending institution show their dedication to area support is by supplying monetary education and proficiency programs. By offering sources and workshops on budgeting, saving, and investing, they empower individuals to make educated financial choices, inevitably adding to the overall well-being of the neighborhood.

Moreover, credit rating unions often partner with local businesses, colleges, and not-for-profit companies to attend to certain neighborhood requirements. Whether it's supporting small companies through lending programs or funding academic campaigns, credit unions play an important role in driving positive adjustment and cultivating a sense of belonging within their areas. Through these collective initiatives, credit report unions not only boost financial success however likewise grow an even more inclusive and resistant wikipedia reference society.

Building a Strong Financial Structure

Developing a strong economic base is important for long-term success and stability in personal and service financial resources. Building a strong monetary foundation involves numerous key components. The primary step is creating a sensible spending plan that lays out revenue, cost savings, investments, and expenses. A spending plan offers as a roadmap for economic decision-making and assists directory people and organizations track their financial progression.

Alongside budgeting, it is crucial to develop an emergency fund to cover unexpected expenditures or monetary problems. Typically, economists recommend conserving three to 6 months' worth of living costs in a quickly available account. This fund offers a safeguard during tough times and prevents people from entering into financial obligation to take care of emergencies.

Furthermore, taking care of financial debt plays a substantial duty in strengthening economic foundations. Wyoming Credit. It is necessary to keep financial obligation degrees convenient and job in the direction of repaying high-interest debts as promptly as feasible. By minimizing financial obligation, services and individuals can maximize more sources for spending and conserving, eventually enhancing their monetary placement for the future

Verdict

In final thought, lending institution play an essential role in promoting financial success via their special benefits, including competitive prices, customized services, area support, and financial education and learning. By prioritizing participant contentment and actively engaging with neighborhood areas, cooperative credit union help individuals and businesses alike construct a solid monetary foundation for long-lasting prosperity and stability. Signing up with a credit union can be a calculated decision for those seeking to attain economic success.

This commitment to participant service can result in customized economic options, such as individualized car loan alternatives or financial education and learning programs, to aid members accomplish their economic goals.

A budget plan serves as a roadmap for monetary decision-making and helps organizations and people track their monetary development.

In final thought, credit rating unions play a crucial role in advertising economic success via their special advantages, consisting of competitive prices, personalized services, neighborhood support, and economic education and learning.

Report this page